Capital Structure Gearing Ratio

Debt comes in the form of bond issues or long-term notes. Shareholders funds In public utility regulation.

Capital Gearing Ratio Formula Meaning How To Calculate With Examples

Capital not bearing risk includes equity.

. The Effect of Capital Structure Gearing Levels on Financial Performance of Public and Private Sector Firms in Kenyas Coastal Counties. Is low geared as its capital structure comprises of 60 of equity capital and only 40 of the fixed cost bearing securities. 20 million of debt.

2 million of annual depreciation expense. Reports the following numbers to the bank. Highly geared Less common stockholders equity.

Therefore one can also say Capital gearing ratio Debentures Preference share capital. Notice that the gearing is inverse to the common stockholders equity. Is high geared as the ratio of equity capital in the total capitalisation of the company is only 40.

Now calculate each of the 5 ratios outlined above as follows. LM Limited has a low-geared capital structure. This is shown by the fact that the common stockholders equity exceeds the fixed cost bearing funds total of preferred stock and.

In case of liquidation senior debt holders have the first claim then junior debt holders and then in the end equity holders get paid if there is anything left. This ratio measures the claims of outsiders and the owners ie shareholders against the assets of the firm. Capital employed CE or CWFR as a of capital employed.

A gearing ratio is a general classification describing a financial ratio that compares some form of owner equity or capital to funds borrowed. For the year 2021. Capital gearing will differ between companies and.

-preference share capital and long term liabilities to the ratio of capital with varied return CWVR-share capital from ordinary shares or CWFR. It actually measures the relationship between the external. 5 million of annual EBITDA.

A gearing ratio is a general classification describing a financial ratio that compares some form of owners equity or capital. 25 million of equity. 3 low-geared 800000 700000.

The capital structure is how a firm finances its overall operations and growth by using different sources of funds. First calculate the gearing ratio using the Debt to equity ratio Debt To Equity Ratio The debt to equity ratio is a representation of the companys capital structure that determines the proportion of external liabilities to the shareholders equity. Capital bearing risk includes debentures risk is to pay interest and preference capital risk to pay dividend at fixed rate.

8 Highly geared The company has a low geared capital structure in 2020 and highly geared capital structure in 2021. The capital gearing in the financial structure of a business has been rightly compared with the. Capital gearing is the degree to which a company acquires assets or to which it funds its ongoing operations with long- or short-term debt.

Capital structure ratios help investors analyze what would happen to their investments in the worst possible scenario. Capital gearing ratio Common stockholders equity Fixed cost bearing funds. Capital structure ratios are calculated to test the long term financial position of the business concern.

Capital gearing ratio 28000003200000. Leverage ratio example 1. Debt-to-equity like all gearing ratios reflects the capital structure of the business.

It helps the investors determine the organizations leverage position and. Investors can gauge what they are likely to recover if the. DebtAssets 20 50 040x.

The followings ratios are calculated to analyze the capital structure of the business concern. Capital structure is an important issue in setting rates charged to customers. Capital Gearing Ratio Equity Share Capital Reserves and Surplus Preference Share Capital Fixed Interest bearing loans or.

A higher ratio is not always a bad thing because debt. Imagine a business with the following financial information. Capital Structure Ratio 1.

50 million of assets. It is also known as External-Internal Equity Ratio. The following points highlight the four ratios used in capital structure.

Capital Gearing Ratio Formula Meaning How To Calculate With Examples

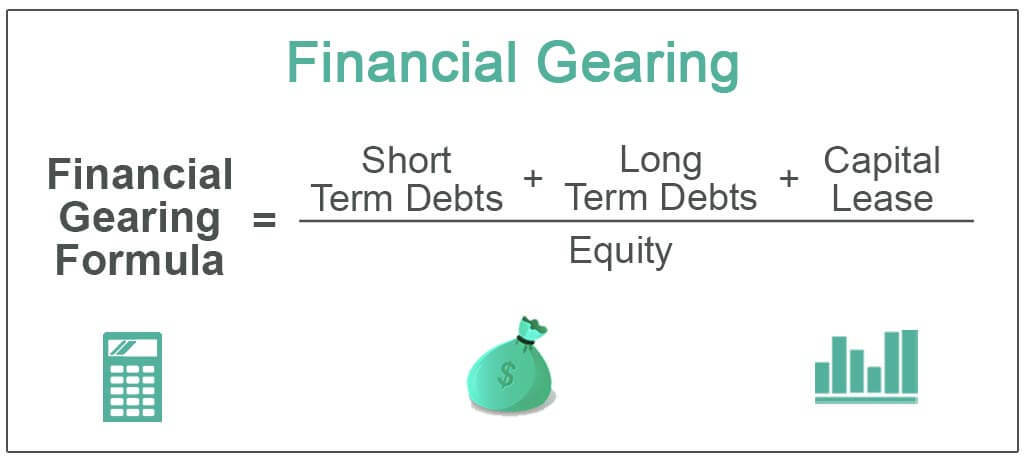

Financial Gearing Ratio Definition Formula Calculation

No comments for "Capital Structure Gearing Ratio"

Post a Comment